New sales strategy delivers Top Line Sales Growth

Revenue for the three months ended March 31, 2014, was $4.7 million, an increase of 44% compared to $3.2 million in stevia-related revenue for the same period last year. We achieved this increase primarily by pursuing sales of higher purity stevia extracts to international customers that generate monthly recurring revenues. This focus was consistent with our strategy of moving away from sales of lower purity stevia extract sales to other China-based stevia providers, in favor of international sales of our higher purity products. As a result, international sales contributed to 48% of Q1 2014 revenues, compared to only 23% in the first quarter 2013, and international sales more than doubled year over year.

Other sales growth initiatives in 2014 include the introduction of the Company's

Cash-based SG&A expenses flat in Q1 2014 compared to Q1 2013

Cash

Non-cash-based SG&A expenses up in Q1 2014 compared to Q1 2013

Non-cash-based selling, general and administration expenses for stock-based compensation and amortization charges increased to $0.6 million for the three months ended March 31, 2014, from $0.3 million in 2013.

Other expenses were up in the first quarter of 2014 due to appreciation of US Dollar relative to the Canadian Dollar

Other expenses for the three months ended March 31, 2014, was $2.4 million, a $0.9 million or 59% increase compared to $1.5 million for the same period in 2013. Other expense increases are driven by the appreciation of the USD against the Canadian

33% increase in net loss in Q1 2014 driven primarily by appreciation of US Dollar relative to the Canadian Dollar

For the three months ended March 31, 2014, the Company had a net loss attributable to the Company of $5.0 million compared to a net loss of $3.7 million for same period in 2013.

Non-GAAP Financial Measures

Gross Profit (Loss) before capacity charges

This non-GAAP financial measure shows the gross profit (loss) before the impact of idle capacity charges are reflected on the gross profit margin

Gross Profit

Improvement in Earnings before Interest Taxes and Depreciation ("EBITDA") and EBITDA Margin achieved in the first quarter of 2014 compared to 2013

EBITDA for the quarter ended March 31, 2014, was negative $1.3 million or negative 28% of revenues, compared to negative $1.2 million or negative 37% of revenues for the same period in 2013.

Financial Resources

Results from Operations

The following results from operations have been derived from and should be read in conjunction with the Company's annual consolidated financial statements for 2013 and the condensed interim consolidated financial statements for the three-month period ended March 31, 2014.

Sales Outlook

The Company plans to focus on four key components to expand its sales in 2014.

1. Continued focus on increasing its international customers of high-purity stevia extracts.

2. Focus on developing Chinese market through its partnership with COFCO.

The Company currently has a number of formulation projects underway with COFCO NHRI and a number of COFCO's key subsidiaries.

3. Expansion of natural sweetener product line to include Luo Han Guo ("LHG") (Chinese Monk Fruit) in 2014.

The Company is currently working with key customers for LHG and expects to be in production in the fourth quarter of 2014, after the harvest of its first fruit. The Company continues to prepare all aspects of its operations for the formal launch of its production including agriculture, regulatory filings and production preparation. The Company plans on utilizing its currently idle plants to produce Luo Han Guo.

4. Sales of other complimentary natural ingredients through its GLG Naturals+ product line in 2014.

The Company is currently quoting a number of these products to existing and new potential customers and expects this product-line to be generating revenues in 2014.

Agriculture Outlook2. Focus on developing Chinese market through its partnership with COFCO.

The Company currently has a number of formulation projects underway with COFCO NHRI and a number of COFCO's key subsidiaries.

3. Expansion of natural sweetener product line to include Luo Han Guo ("LHG") (Chinese Monk Fruit) in 2014.

The Company is currently working with key customers for LHG and expects to be in production in the fourth quarter of 2014, after the harvest of its first fruit. The Company continues to prepare all aspects of its operations for the formal launch of its production including agriculture, regulatory filings and production preparation. The Company plans on utilizing its currently idle plants to produce Luo Han Guo.

4. Sales of other complimentary natural ingredients through its GLG Naturals+ product line in 2014.

The Company is currently quoting a number of these products to existing and new potential customers and expects this product-line to be generating revenues in 2014.

The Company has arranged planting of its H3 Leaf in China in 2014. Analysis of its H3 and H4 leaf compared to other competitors' leaf available in China clearly shows GLG's lead in providing a seed that generates a significant amount of steviol glycosides in the leaf (13 to 15% range), a high percentage of Rebaudioside A (65 to 70% range) and a larger weight per acre planted than any other varieties available in China. The weight per acre is a key metric of interest to farmers in China who are evaluating whether to grow our stevia leaf versus other alternative crops or competing stevia seedlings.

The Company is also pleased to report on the success of its non-GMO hybrid breeding program which has resulted in a number of new strains that it plans to develop, which have individual advantages such as:

- higher amounts of total steviol glycosides and higher amounts of Rebaudioside A.

- higher amounts of targeted glycosides such as Rebaudioside C, Rebaudioside D and Rebaudioside M. The Company has seen some new seedling varieties with double to triple the amount of these strategic glycosides.

- The Company will continue on to the next step to bring these proprietary seedlings to the next stage of development and expects availability for planting within the next 3 to 5 years.

Contact:

Stuart Wooldridge, Investor

Phone: +1 (604) 669-2602 ext. 104

Fax: +1 (604) 662-8858

Email: ir@glglifetech.com

About GLG Life Tech Corporation

GLG Life Tech Corporation is a global leader in the supply of high purity stevia extracts, an all-natural zero-calorie sweetener used in food and beverages. The Company's vertically integrated operations cover each step in the stevia supply chain including non-GMO stevia seed breeding, natural propagation, stevia leaf growth and harvest, proprietary extraction and refining, marketing and distribution of finished product. For further information, please visit www.glglifetech.com.

Forward-looking statements: This press release contains certain information that may constitute "forward-looking statements" and "forward looking information" (collectively, "forward-looking statements") within the meaning of applicable securities laws. Such forward-looking statements include, without limitation, statements evaluating the market, potential demand for stevia and general economic conditions and discussing future-oriented costs and expenditures. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes" or variations of such words and phrases or words and phrases that state or indicate that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

While the Company has based these forward-looking statements on its current expectations about future events, the statements are not guarantees of the Company's future performance and are subject to risks, uncertainties, assumptions and other factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors include amongst others the effects of general economic conditions, consumer demand for our products and new orders from our customers and distributors, changing foreign exchange rates

Further, although the Company has attempted to identify factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

As there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements, readers should not place undue reliance on forward-looking statements.

Disclaimer/ Disclosure: The Investorideas.com newswire is a third party publisher of news and research as well as creates original content as a news source. Original content created by investorideas is protected by copyright laws other than syndication rights. Investorideas is a news source on Google news and Linkedintoday plus hundreds of syndication partners. Our site does not make recommendations for purchases or sale of stocks or products. Nothing on our sites should be construed as an offer or solicitation to buy or sell products or securities. All investment involves risk and possible loss of investment. This site is currently compensated by featured companies, news submissions, content marketing and online advertising. Contact each company directly for press release questions. Disclosure is posted on each release if required but otherwise the news was not compensated for and is published for the sole interest of our readers Disclosure: GLG Life Tech Corporation (TSX: GLG) April 9th 2014 - two months news and content publication , two thousand five hundred per month. More disclaimer info: http://www.investorideas.com/About/Disclaimer.asp

BC Residents and Investor Disclaimer : Effective September 15 2008 - all BC investors should review all OTC and Pink sheet listed companies for adherence in new disclosure filings and filing appropriate documents with Sedar. Read for more info: http://www.bcsc.bc.ca/release.aspx?id=6894. Global investors must adhere to regulations of each country.

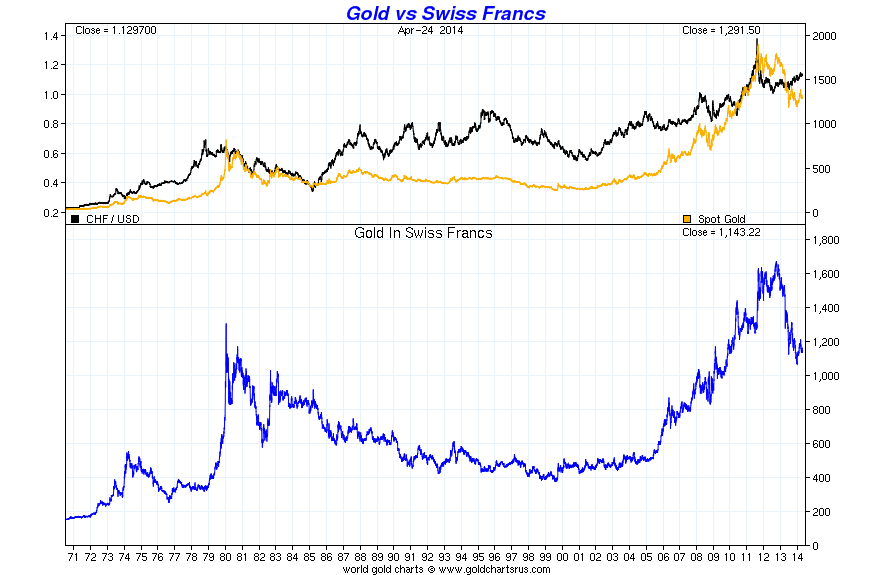

Gold is, along with silver, the oldest money in the world, hence its unbreakable relation with the

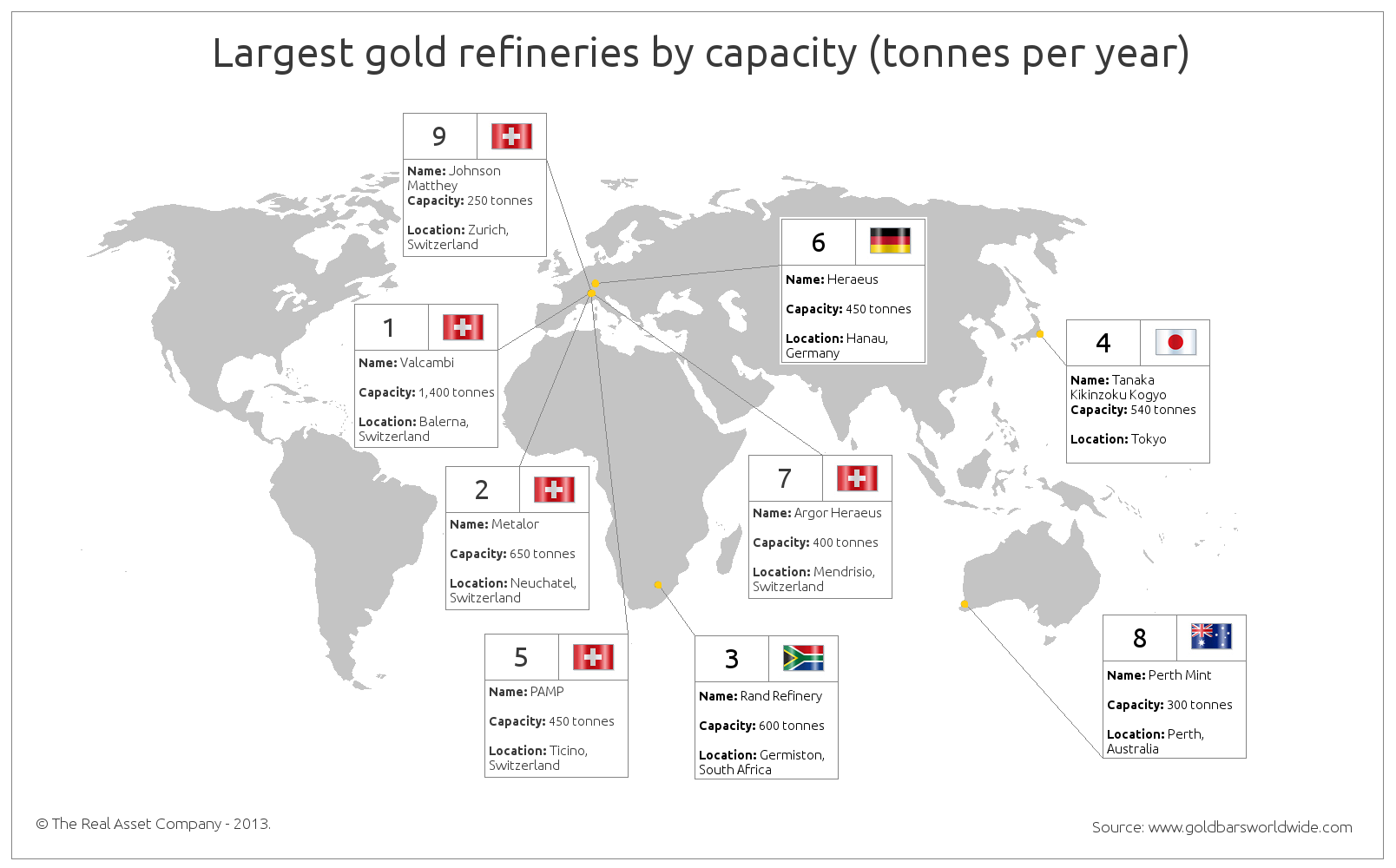

Gold is, along with silver, the oldest money in the world, hence its unbreakable relation with the  Largest Gold Refineries by Capacity (tonnes per year)

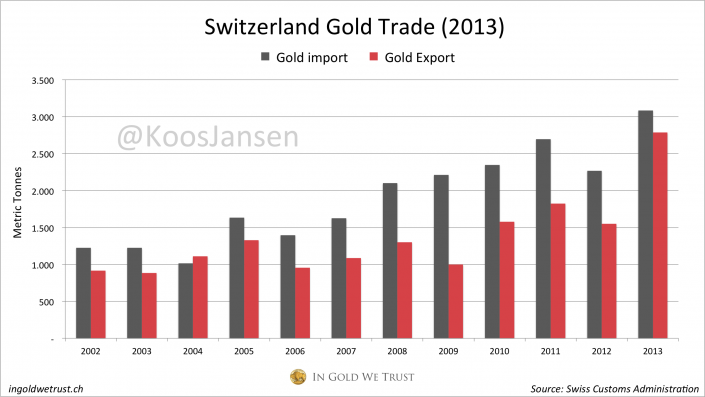

Largest Gold Refineries by Capacity (tonnes per year) Switzerland's Gold Trading (2013)

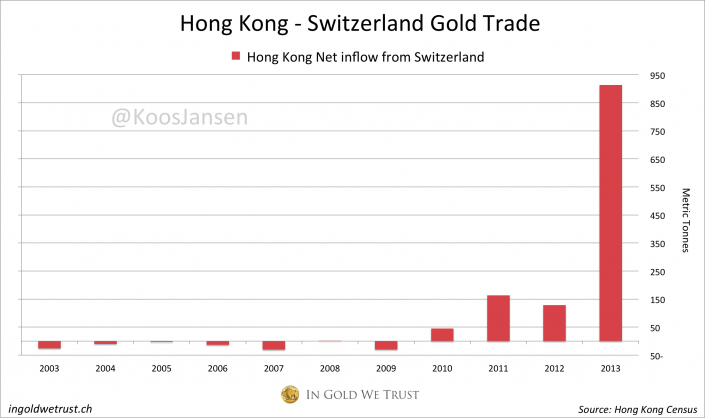

Switzerland's Gold Trading (2013) Gold Trading between Hong Kong and Switzerland

Gold Trading between Hong Kong and Switzerland Notes :

Notes :